One of the most common sources of tension in a relationship is figuring out how to share the cost of living together. Rent, groceries, bills, streaming subscriptions — who pays what? The answer isn’t always 50/50. What matters most is finding a method that feels fair to both partners and supports your financial goals as a couple.

Why This Conversation Matters

Avoiding the money talk leads to resentment, confusion, and imbalance. Clear agreements build trust, respect, and teamwork. The key is to move from assumptions to intentional decisions that work for both of you.

Start by Listing All Shared Expenses

Write down every monthly cost you both use or benefit from. Examples include:

Rent or mortgage

Utilities (electricity, water, gas)

Internet and phone bills

Groceries and household items

Streaming or subscription services

Transportation

Pet costs

Childcare or education expenses (if applicable)

Being clear about which costs are truly shared sets the stage for fair division.

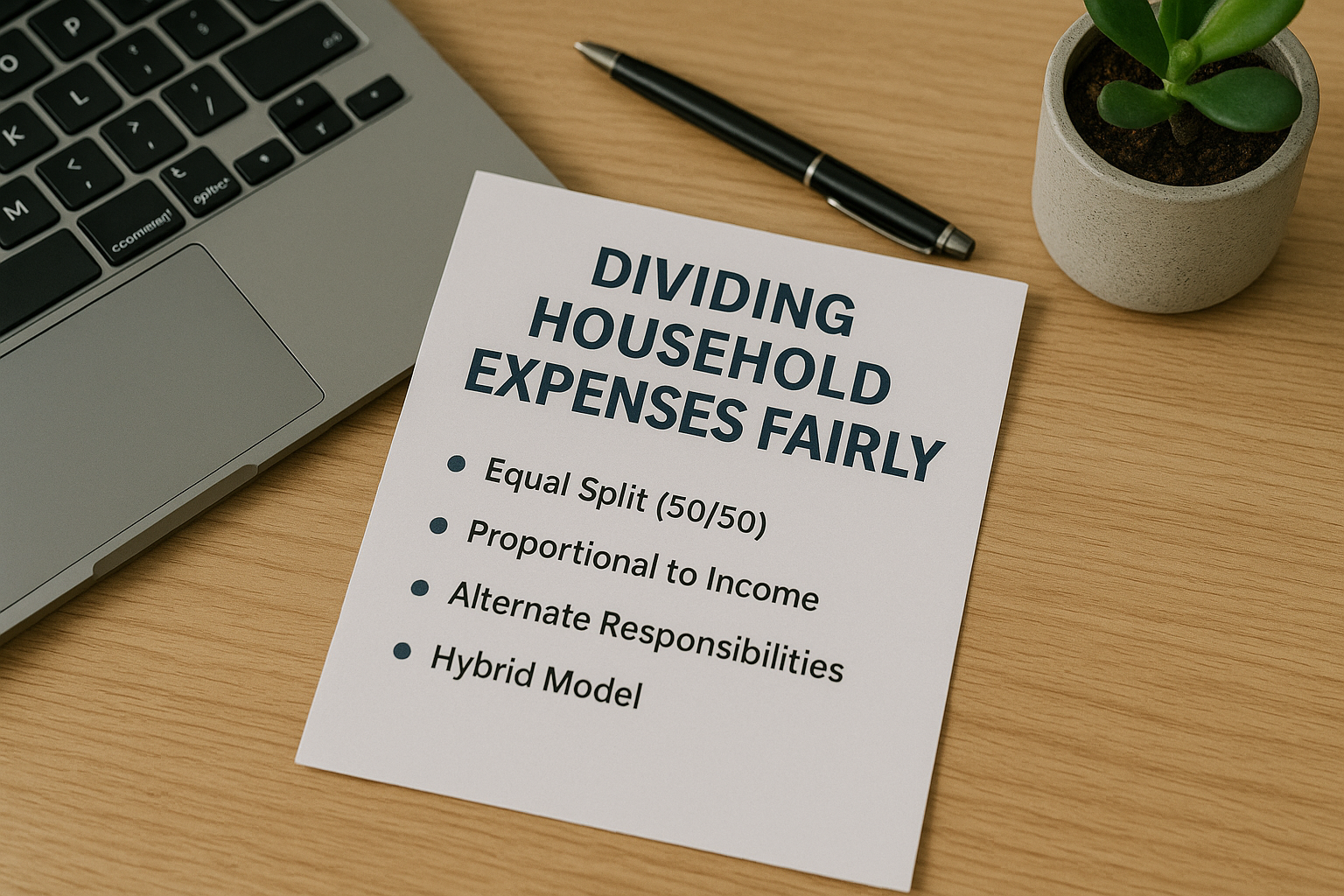

Choose a Cost-Splitting Method That Works for You

There are several ways couples divide expenses. Here are the most common models:

Equal Split (50/50)

Each partner contributes the same amount to shared costs.

Best for: Couples with similar incomes and lifestyles.

Proportional to Income

Each partner contributes based on how much they earn. For example, if one partner earns 60% of the household income, they contribute 60% of the expenses.

Best for: Couples with income gaps who still want fairness.

Alternate Responsibilities

Instead of splitting every bill, divide responsibilities. One pays rent, the other covers groceries, for example.

Best for: Couples who value simplicity and don’t track every dollar.

Hybrid Model

Use a combination. Split fixed bills 50/50 and divide variable costs like groceries based on income or habit.

Best for: Couples who need flexibility and customization.

There’s no perfect method — only what feels equitable to both partners.

Talk About Lifestyle Differences

Spending habits and lifestyle expectations can affect how fair an arrangement feels. If one partner prefers organic groceries and high-speed internet, and the other’s fine with basic, it’s important to find compromise.

Ask:

Do we agree on what’s essential vs. luxury?

Are we both comfortable with the total household spending?

Do we need to set limits or adjust categories?

Discussing these differences early helps avoid future frustration.

Use a Joint Account or Shared Budgeting Tool

Many couples choose to create a joint account specifically for shared expenses. Each partner contributes an agreed amount monthly, and bills are paid from this account.

Alternatively, you can use budgeting apps like Splitwise, Honeydue, or a shared spreadsheet to track who paid what.

This clarity helps avoid confusion, forgetfulness, or mismatched expectations.

Don’t Forget About Irregular Expenses

Some costs don’t come every month but should still be considered:

Annual insurance premiums

Holiday gifts

Car repairs or registration

Medical or dental expenses

Set aside money regularly for these categories or agree on how you’ll handle them when they arise.

Review the Arrangement Regularly

Your incomes, bills, and needs will change over time. What works today may not work next year.

Schedule a check-in every 3–6 months to ask:

Are we both comfortable with the current arrangement?

Is anyone feeling overburdened?

Do we need to adjust contributions?

Make these check-ins a healthy, honest habit — not a confrontation.

Respect Financial Boundaries

If you’re not fully merging finances, it’s important to respect each other’s personal money choices. As long as shared responsibilities are met, what each partner does with their remaining income is their choice.

Trying to control or judge personal spending creates power imbalances and resentment.

Final Thought: Fair Doesn’t Always Mean Equal

Every couple is different. The goal isn’t perfect math — it’s mutual respect, clear communication, and a system you both believe in.

The best financial partnerships aren’t based on strict rules but on shared values. Find what works for you, stay flexible, and always put the relationship before the receipt.